According to Vanguard, the vast bulk of muni defaults were the result of highly indebted single issuers or bonds tied to special projects like stadiums or transportation projects. Looking at historical muni defaults, a trend begins to emerge. On the backdrop of higher state slush funds and only a slight dip in revenues, investors need to focus on the kinds of munis that are in danger and that have historically defaulted. To put that in context, the Great Recession saw state revenues fall by 8% in 2009. Moreover, a potential recession is expected to shrink state government revenues by just 3.1% for all of 2023.

According to Nuveen, on average, states’ budget stabilization funds have grown to 12.4% of general fund expenditures in 2022. Thanks to stimulus cash and the last few boom years, many states have beefed up their rainy-day funds. But if history is a guide, munis are as safe as ever.įor starters, state and local government finances are actually pretty good. It’s no wonder investors may be concerned with their fixed income portfolios. That’s more than 2022’s default of around $1.33 billion.Ĭheck out this article to know more about the potential risks associated with muni bonds.Ī potential 58% year-over-year increase in the number of defaults in a normally very sleepy sector is nothing to sneeze at. For example, Bank of America now estimates roughly $1.7 billion to $2.1 billion worth of muni bonds will default in 2023.

Muni defaults torrent#

As such, the spigot of cash that state and local governments pay for munis can quickly go from a torrent to a trickle.Īnd that’s what some analysts have predicted for the new year. Going out further, declining property values can hit property taxes. At the same time, lower revenues for corporations result in employee layoffs. Lower sales at companies directly impact corporate taxes.

Recessionary forces have the ability to hurt cash flows that support munis. Some analysts are predicting more could be in store throughout the year. Meanwhile, the average five-year municipal default rate since 2012 has increased to 0.1%, up from 0.08% since 1970. That marks the third highest month since 2019. For January, first-time payment defaults have jumped 122% year-over-year to reach $611 million. And so far, this year, those defaults have happened more often. For example, California or Texas can-in theory-raise taxes enough to cover their obligations and make investors whole.Īs a result, munis often form the backbone of many retail investors’ taxable accounts and institutional investors’ fixed income portfolios.īut the thing is munis aren’t as ‘good as gold.’ Occasionally, defaults do happen. Pension, endowment, and insurance funds love them because of their stability and safety.

Muni defaults free#

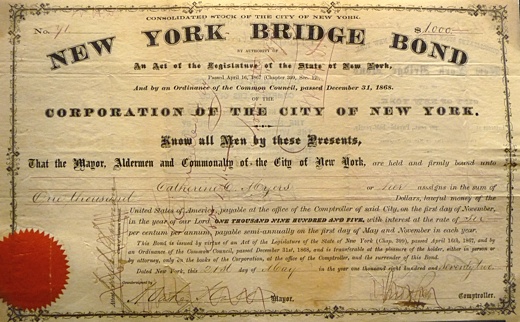

Interest from munis is generally free from federal taxes and can also be free from state and local taxes, depending on the issuer. Investors-particularly high-income earners-love them because of their tax-free nature. Municipal bonds are issued by states, local governments, public universities, and other entities to help fund special projects or general operations.

0 kommentar(er)

0 kommentar(er)